Welcome to my latest video presentation, dated Friday, April 5. The accompanying article is a condensed transcript; my video contains additional details.

The safety scandals that are pummeling Boeing’s stock price, as well as its aircraft values, provide an instructive case study for aviation stakeholders, including lessors, lessees, investors, and operators. Here’s an update on the continuing Boeing saga.

News emerged on April 4 that Boeing paid Alaska Airlines, operated by Alaska Air Group, $160 million in initial compensation for the blowout of a panel during flight.

The mishap occurred on January 5, when a “door plug” on a Boeing 737 MAX 9 aircraft flown by Alaska Airlines failed midair, exposing passengers to the elements thousands of feet above the ground.

News reports on April 5 revealed that Virgin Galactic has filed a countersuit against Boeing over a project to develop a new mothership aircraft, arguing in part that Boeing has performed poorly. Virgin Galactic is concerned about Boeing’s sullied reputation for safety.

The suit, filed April 4 in the U.S. District Court for the Central District of California, comes two weeks after Boeing filed suit against Virgin Galactic in Virginia, alleging that Virgin refused to pay more than $25 million in invoices on the project and misappropriated trade secrets.

The U.S. Department of Justice (DOJ) has initiated a criminal investigation into the aerospace giant over its MAX family planes.

The U.S. Federal Aviation Administration (FAA) confirmed in March that a six-week audit by the agency of Boeing’s production of the 737 MAX 9 jet found dozens of failures and dangerous shortcuts throughout the manufacturing process.

The FAA conducted 89 product audits of the MAX 9; Boeing passed 56 of the audits and failed 33 of them, with a total of 97 instances of alleged noncompliance.

Wait. It gets worse. On March 11, it was reported that a Boeing whistleblower was found dead of a self-inflicted gunshot wound. The apparent suicide is under investigation.

Boeing announced a management shakeup on March 25. At the end of the year, CEO Dave Calhoun will resign. Boeing Board Chair Larry Kellner also will step down, handing over his reins to Director Steve Mollenkopf at the company’s annual meeting in May.

Boeing Commercial Airplanes President and CEO Stan Deal also resigned March 25, effective immediately. Chief Operating Officer Stephanie Pope has taken his place.

Over the years, Boeing cut corners and scrimped on safety, to boost profits. The company sold its soul to lift its stock price, but karma has caught up with the company.

Boeing’s stock is a “blue chip” staple of many retirement portfolios. The stock has long been considered a “Steady Eddy” performer. Not anymore. Year to date, the stock has lost more than a quarter of its value. Take a look at the following stock price chart:

A consumer boycott of Boeing has emerged, with nervous travelers going so far as to re-book flights to get on a plane made by archrival Airbus.

A consumer boycott of Boeing has emerged, with nervous travelers going so far as to re-book flights to get on a plane made by archrival Airbus.

Safety and production problems have put Boeing well behind European-based Airbus, which delivered 735 aircraft in 2023 to Boeing’s 528. Several of the airlines that use Boeing aircraft are angry and they’re looking to replace Boeing with its competitors.

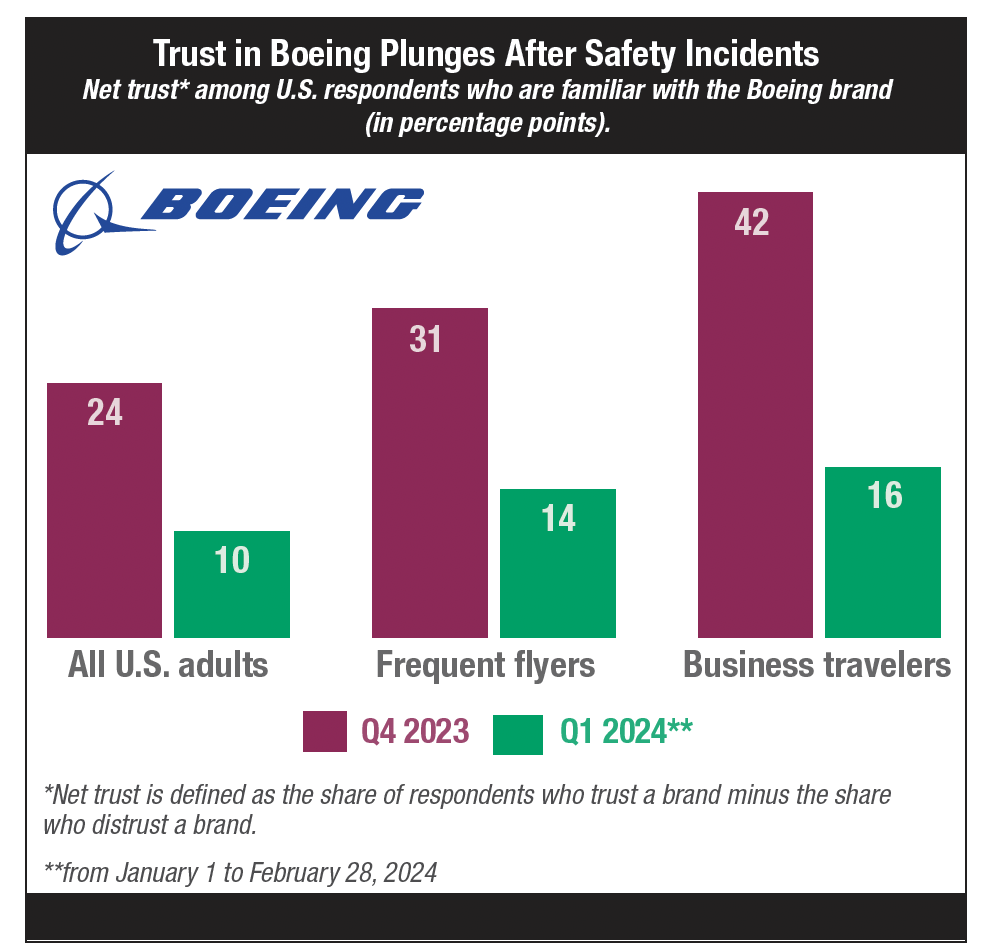

Within the context of questions over Boeing’s highly publicized problems, the research firm Morning Consult Brand Intelligence recently conducted a survey on public trust in the aircraft maker.

Morning Consult found that between the fourth quarter of last year and January 1-February 28 of 2024, net trust had declined among respondents by 14 percentage points.

The following chart tells the sad story of Boeing’s fall from grace:

Net trust is defined as the share of respondents who trust a brand minus the share who distrust a brand.

Net trust is defined as the share of respondents who trust a brand minus the share who distrust a brand.

As you can see from the chart, the biggest change was among business travelers, with a 26 percentage point difference between the two survey waves.

Boeing was for decades the crown jewel of American aviation. Now, the company’s reputation lies in tatters. Once a respected icon, Boeing has become the butt of jokes by late-night comedians. That’s never a good sign.

I’ll keep an eye on this unfolding tragedy and what it means for lease rates and values for the affected aircraft models. Perhaps Boeing can turn things around; we’ll see.

Thanks for watching. And if you have any questions or feedback, please don’t hesitate to send me an email: [email protected]